In a crowded eCommerce space, differentiation has become a near-impossible, Olympian goal. Yet, we still see the rise of fast-growing brands like Warby Parker, which brought in an estimated $250 million in 2017 alone.

To stay competitive, they need a constant feedback loop. But, traditional methods of gauging satisfaction — questionnaires and surveys — are limiting because they only provide answers to the questions asked. That’s where reviews come in. They give you access to the entire range of your customers’ experiences, in their own words.

Using sentiment analysis technology, we evaluated millions of reviews from U.S. fashion shoppers to identify the topics and issues that matter most them.

Measuring customer satisfaction with sentiment analysis

Business of Fashion’s recent report on the State of Fashion in 2018 named artificial intelligence as one of the major industry game changers. Buzzwords aside, it’s AI — specifically sentiment analysis — that empowers eCommerce businesses to automatically analyze customer reviews at scale so they can identify trends in customer satisfaction in real time.

This report identifies patterns in sentiment that point to trends of customer satisfaction (and lack thereof) across the United States. In it, you’ll find exclusive takeaways that can give you an edge in customer satisfaction.

The importance of customer satisfaction: Where star ratings fall short

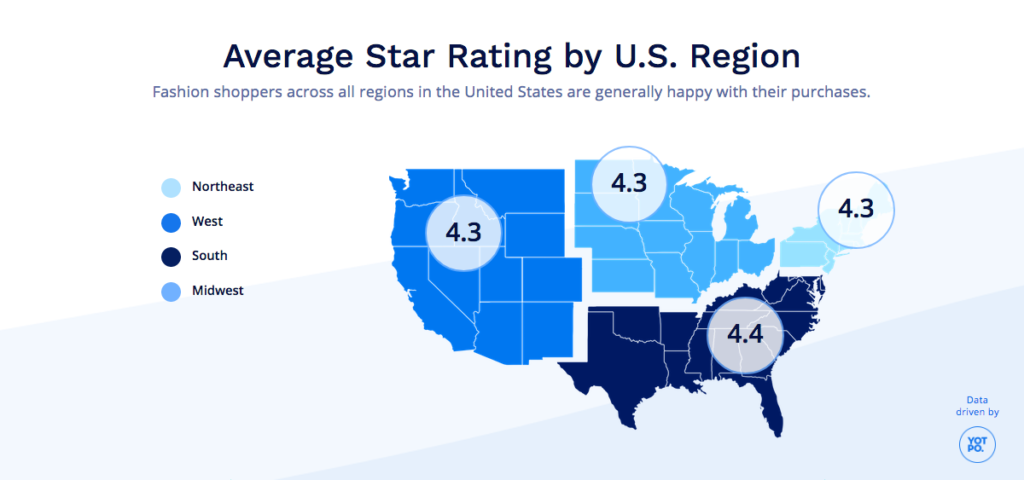

Despite the fact that the U.S. is consistently portrayed as the land of plenty where nothing is ever enough, the majority of American fashion shoppers are pretty happy.

The average star rating for fashion purchases across the U.S. is 4.3, with New Mexico taking the lead at 4.5 stars and Nevada trailing behind at 4.1 stars.

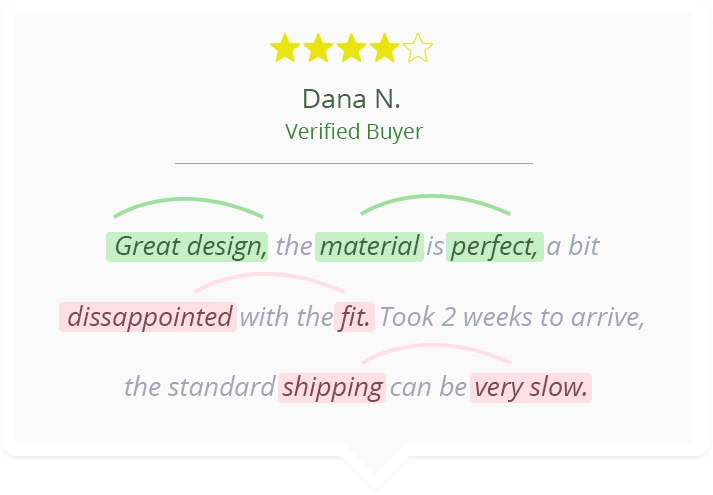

It would be easy to leave things at that — 4.3 stars on average paints the picture of happy consumers. But that’s only part of the story. Even 4 and 5-star reviews can include negative opinions about several topics that would be easy to miss without a more nuanced analysis.

Just take a look:

With sentiment analysis, brands can pinpoint customer satisfaction issues that would be easy to overlook, especially among best-selling, highly rated products. Whether that issue is fit or shipping, or even a faulty zipper or clasp, you’re able to invest in the changes that your customer wants, without any guesswork.

The same is true for products with low star ratings — it’s likely that there is a specific problem, rather than a faulty product overall. The insights aggregated through sentiment analysis save you from going back to the drawing board and allows you to focus your product cycle on refining particular issues that customers are talking about rather than on complete redevelopment.

*Topics ordered by descending frequency from largest to smallest font size.

Consumer sentiment on size and fit

By identifying the most commonly mentioned topics and analyzing their sentiment score, we can immediately spot nation-wide trends that indicate issues endemic to the fashion industry.

A key example that we found in our analysis is customer sentiment on the topics of “size” and “fit.” Size consistently ranks with a 50% lower sentiment score than fit in all regions. This indicates that when people purchase clothing in the correct size, it fits nicely, but that getting the right size in the first place is a challenge.

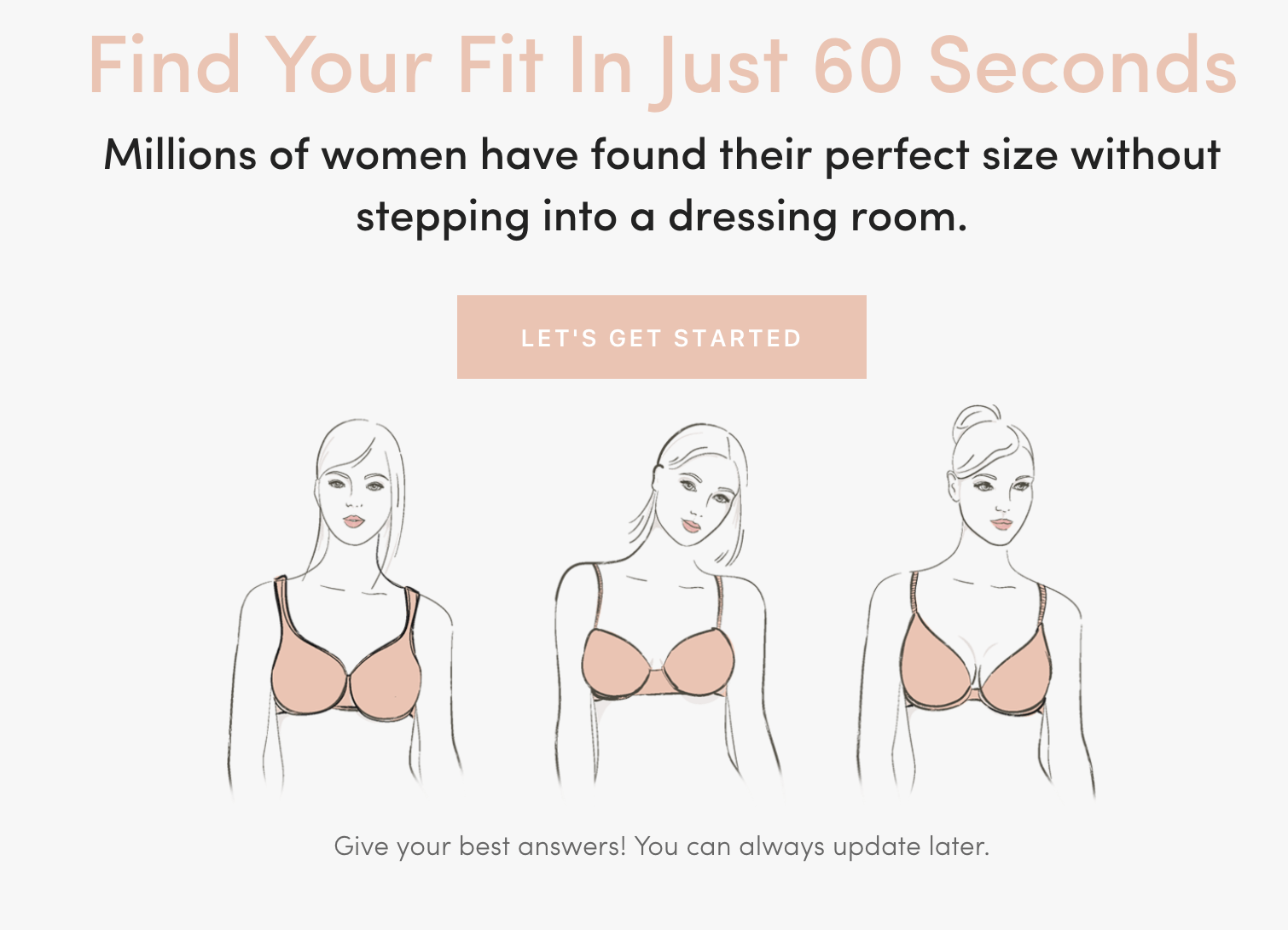

For brands, this is an opportunity to re-label clothing with sizes that more accurately reflect their measurements, or to offer more helpful, informative sizing descriptions to ensure customers’ expectations match what they receive.

This digital questionnaire helps shoppers find the right bra for their body type by asking plenty of detailed questions and offering suggestions about style, size, and fit based on the replies. Working from what they learned about their customers’ needs, ThirdLove expanded their offering to include 60 sizes in bras, more than any other lingerie brand. The combination of their interactive sizing tool and impressive size range has allowed them to turn this common problem area into a unique opportunity for differentiation.

Shipping and packaging: Where should you focus your efforts?

American fashion shoppers are satisfied with shipping overall, with the topic ranking as positive across all four regions. Still, when breaking down the sentiment by major city centers, we learned that Los Angeles shoppers are 10.3% happier with shipping than New Yorkers — worth keeping in mind if you’re planning to invest in optimizing your state-side shipping operations.

Hand-in-hand with shipping and delivery comes packaging. As you zero in on customer satisfaction and experience, one of the key opportunities for delighting your customers has to do with how they receive your products. In our Millennial age, unboxing is a big deal, with YouTube channels dedicated to the experience and companies like Lumi that focus on creating custom packaging for eCommerce brands.

While packaging did not come up as an area of concern sentiment-wise, we saw a 10% lower sentiment score in how Northeastern and Western states feel about the topic as compared with Midwestern and Southern states. Home to the marketing and entertainment capitals of NYC and LA, it’s likely that the coastal regions have come to expect more from packaging as part of the branding experience. Testing out new packaging ideas in these regions is a sure-fire way to develop an unboxing experience that will excite shoppers across the country while raising local sentiment about the topic.

What fashion shoppers think about fabric

Sometimes what your customers aren’t saying can be as powerful a tool for demand and trend forecasting as their most frequently mentioned topics. One of our most surprising findings was that U.S. fashion shoppers are not talking about “fabric” or “material” as frequently as you would think. These two topics were only among the top 5 mentioned the Northeast, and both had a positive sentiment score.

Findings like this allow retailers to avoid the pitfall of common assumptions (i.e. that apparel shoppers frequently complain about fabric), which can lead them astray when allocating resources. These findings also provide opportunities: For example, companies that receive most of their orders from the Northeast would do well to include additional information about material in their product descriptions, since it’s clearly important to customers there. A low-effort change like this can help brands better connect with what their customers care about.

What shoppers dislike about your brand and how to fix it with service

Looking at the most common topics to come up in reviews is one way to identify opportunities to improve products and services, but looking specifically at what your customers are complaining about can also be eye-opening.

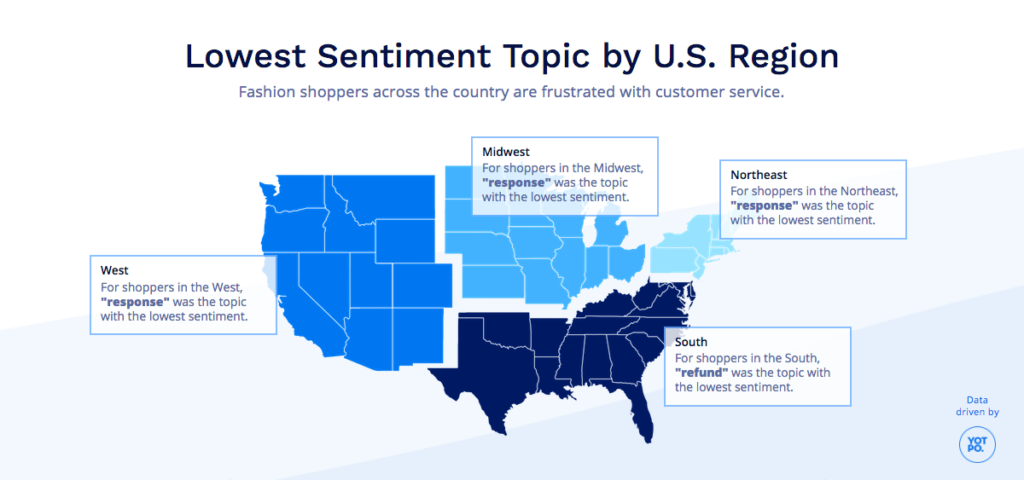

We gathered the topics with the lowest sentiment scores across the board and found that Americans’ most serious grievances have nothing to do with fabric or fit.

Take a look at the topics that get shoppers in each region the most upset:

With “response” and “refund” scoring lowest of all review topics, it’s clear that American fashion shoppers feel strongly about customer service, versus product.

The good news is that customer experience is one of the quickest fixes you can make. While redeveloping a product can take a lot of time and preparation, improving customer service response times or creating a better refund policy can have a maximal effect in a shorter period of time. Even something as simple as changing a product description can help address issues raised by your customers. Efforts like these improve your reputation in an ecosystem where brand is everything.

Conclusion

The importance of customer satisfaction is undeniable, and we finally have the technology in place to analyze customer experience at scale, without sacrificing the details. Harnessing your customer insights is the key to fine-tuning your brand and differentiating your business.

While listening to your own customers will tell you what you need to know for your brand, this broad view of U.S. fashion shoppers gives you the stepping stones to get started:

- Don’t take star ratings at face value. Sentiment tells you more about your products than stars.

- Improve your sizing. Whether this means labeling your clothes more accurately or providing a super clear size chart on site, cutting down on incorrect sizing will mean fewer returns and more satisfied customers.

- Focus packaging efforts in the Northeast and the West. If you can get the unboxing experience right there, you’re likely to please the rest of the country as well.

- Focus on service above product. American shoppers are far and away most frustrated with the topics “response” and “refund.” Refine your customer service policies and standards before investing in your product cycle.

Join a free demo, personalized to fit your needs

Join a free demo, personalized to fit your needs