Buy Now, Pay Later: The Benefits of Offering Flexible Payments

When it comes to payments, flexibility is your best strategy. The more options available at checkout, the easier it will be for you to make a sale.

Product Page Guide

Product Page Guide

When it comes to payments, flexibility is your best strategy. The more options available at checkout, the easier it will be for you to make a sale.

Get 19 lessons from top experts delivered straight to your inbox

Your information will be treated in accordance with our Privacy Policy

Flexible payments are one of the fastest-growing segments in digital sales, especially among millennials and Gen Z. If you consider the fact that 67% of young buyers don’t have credit cards, it’s easy to see why.

In this chapter, we’ll explore the benefits of flexible payments, so you can determine if it’s something you want to offer your customers.

Flexible payments give your customers the option to “buy now, pay later” (BNPL) and/or pay in installments, similar to a credit card, but without the high interest rates. The advantage for customers is clear, but it’s also a great way for brands to drive sales.

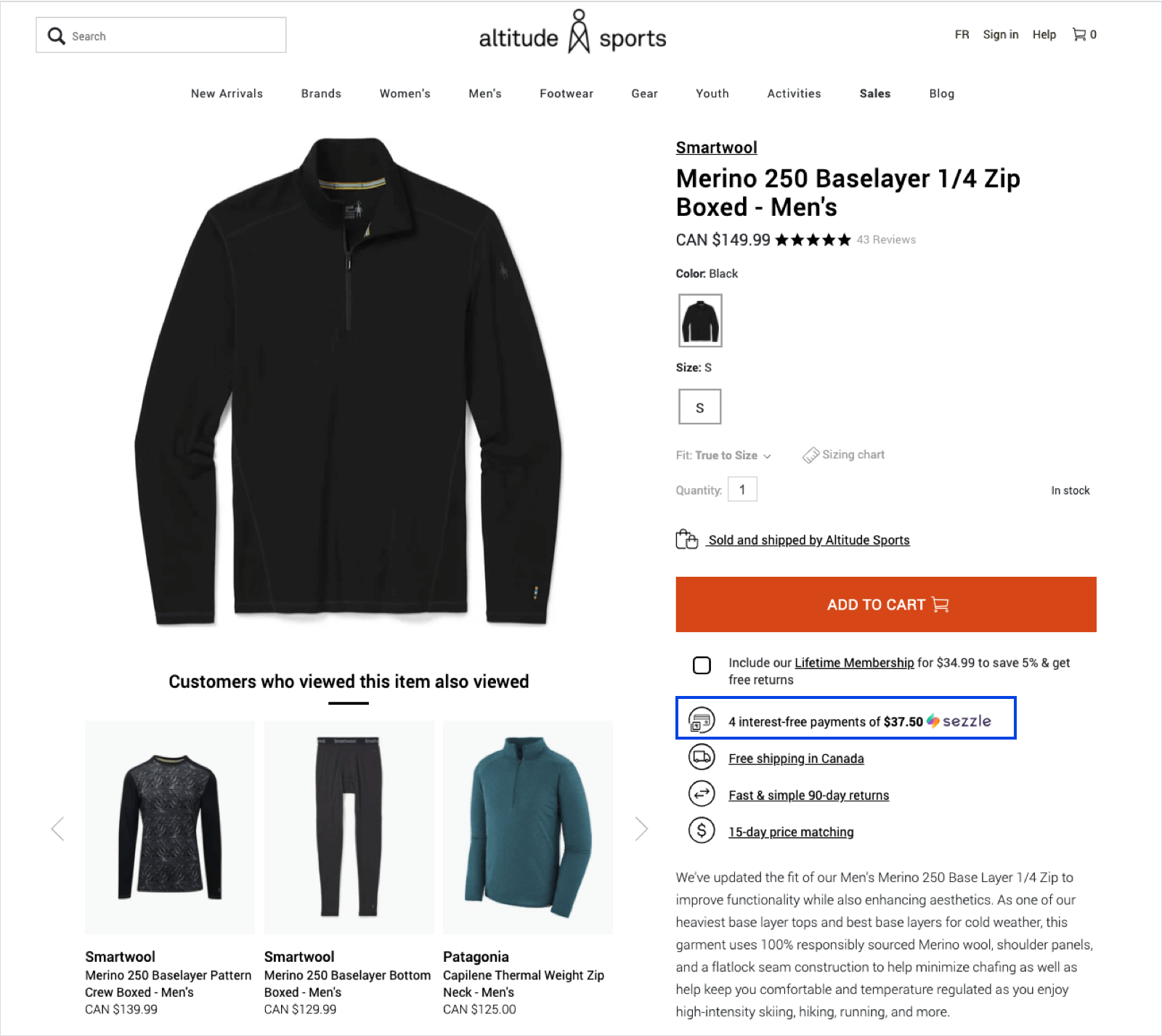

On product pages, flexible payment options are often incorporated as widgets, like the one you see below from Sezzle, on Altitude Sport’s online store.

Many flexible payments brands, including Sezzle, take on the legwork of collecting payments. That means never having to deal with fraud or risk; you get paid upfront, and your payment provider gets paid later.

In terms of costs, companies that offer flexible payments typically take a small percentage of each BNPL sale. They are generally integrated with the major eCommerce platforms, like Shopify, Magento, and WooCommerce. Costs and integrations vary between BNPL providers, so you’ll want to take your budget and the tools you use to power your store into account when choosing a company.

Flexible payment providers like Sezzle make offering more payment options easy, seamless, and hands-off. And they also help to boost your revenue! Read on to learn how.

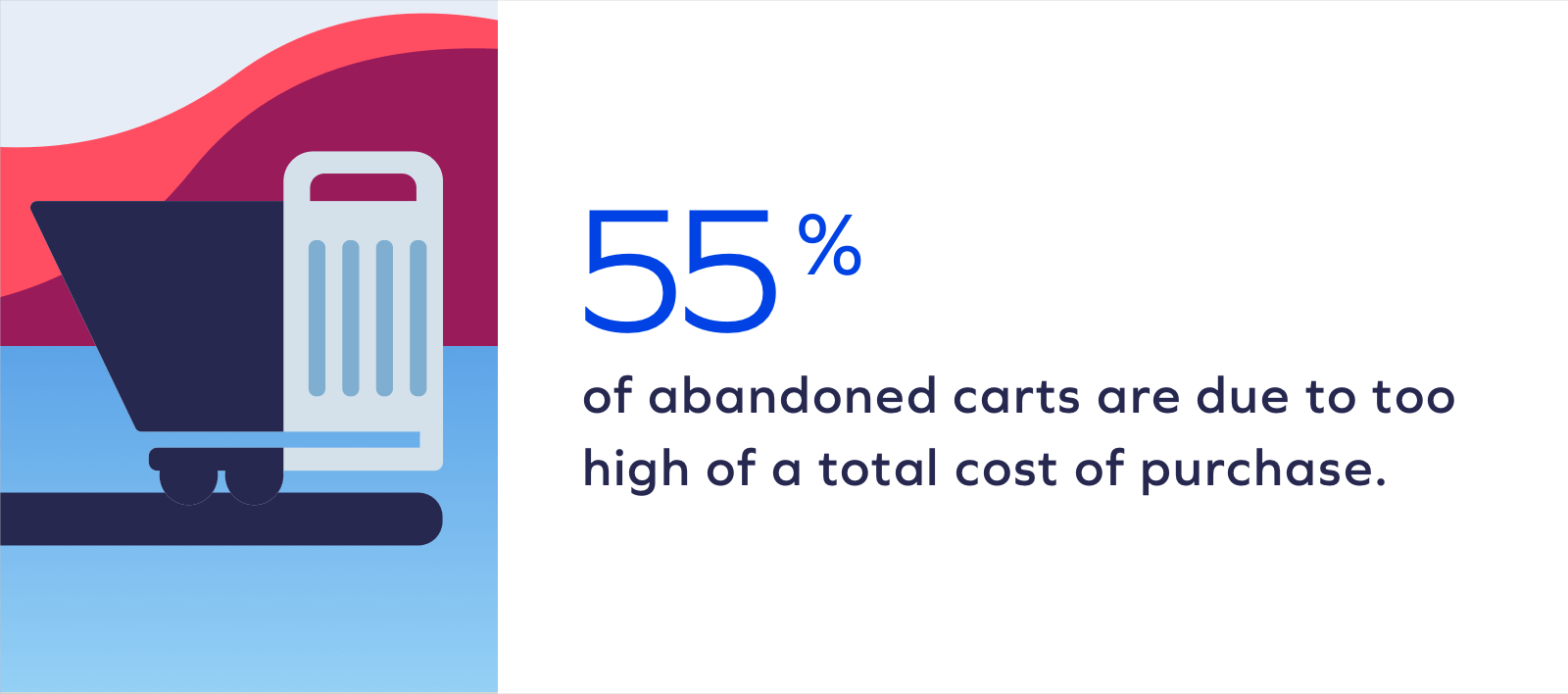

Why do customers abandon product pages or carts? There are a lot of reasons, including ease of use, shipping costs and options, and security concerns.

Sezzle’s research shows that 55% of abandoned carts are due to too high of a total cost of purchase. That’s one area where flexible payments can make a huge difference.

Let’s say a customer wants to buy a jacket that’s on sale for $100. The customer doesn’t have a credit card, and doesn’t want to use their debit card because they don’t get paid until after the sale is over. Without a “buy now, pay later” option on the product page, you’ll lose that sale.

Our clients see increased add to carts from product pages with our widgets, and more total conversions. Flexible payments are especially helpful for selling high-ticket items, offering options to shoppers without a credit card who are better able to pay over time.

Additional research shows that more than half of consumers say they would spend more when shopping at a store or website if they offered an installment payment solution. That means in addition to that $100 jacket on sale in the above example, that customer may purchase a matching scarf, because they know they have a flexible way to budget their purchase over time, with no interest.

Flexible payments allow you to meet customers where they are, an approach that’s essential in the age of personalization. This translates both to new customers and more loyal customers, who may choose your product over that of a competitor because you offer those options.

When you convert a consumer with advanced payment options, there’s a good chance you’ll retain them. The next time that customer looks for a similar product, they’ll come to you, because they already know that you offer their preferred payment method. And if you can keep that customer happy and engaged, you’ll turn them into a loyal customer and brand advocate.

When you partner with a flexible payments solution provider, you aren’t just getting more options to offer your existing customers at checkout; you’re getting a tool for discovery, too. Sezzle, for example, offers partner brands access to our store directory on our website and app. This connects you with shoppers who already love flexible payments.

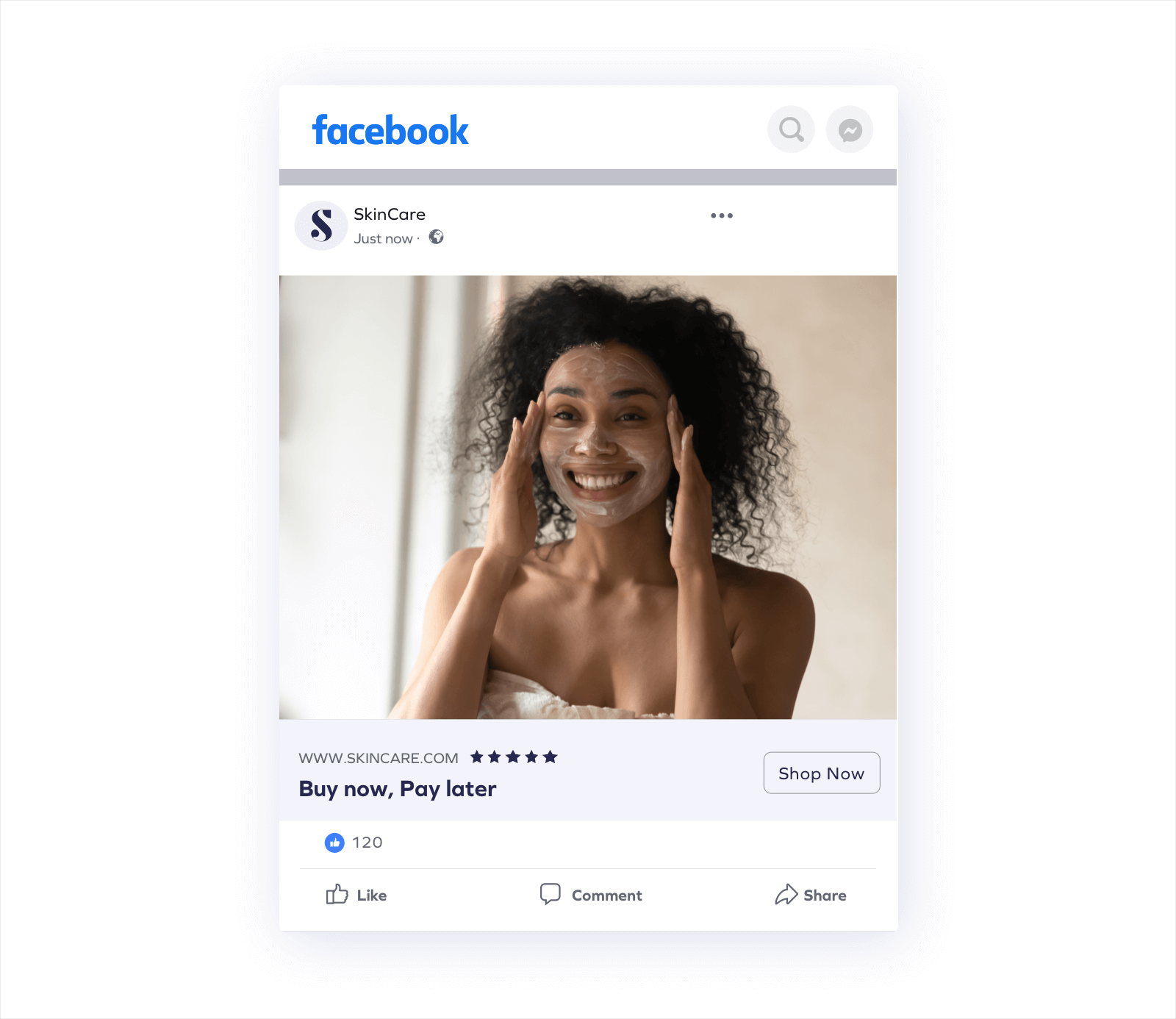

BNPL options also offer you a point of differentiation for your online marketing efforts. Plus, it gives you powerful messaging for remarketing and abandoned cart follow-up. If a consumer visits your store and browses but doesn’t add anything to their cart, you can serve them remarketing ads on Google and Facebook highlighting your flexible payment options. Likewise, if a customer adds an item to their cart but doesn’t complete their purchase, a message informing or reminding them about BNPL can convince them to come back and complete the purchase.

In the midst of the COVID-19 pandemic, customers are shopping online more than ever before. Offering flexible payments gives brands an opportunity to tap into a new and growing customer base. And in uncertain financial times, customers will feel safer making purchases when they know they have several different options to pay for them over time.

Your information will be treated in accordance with our Privacy Policy

This will take just a moment…We're finding the right person on our team to help your brand!

“Yotpo is a fundamental part of our recommended tech stack.”

Laura Doonin, Commercial Director

Laura Doonin, Commercial Director

Join a free demo, personalized to fit your needs

Join a free demo, personalized to fit your needs